Trusts which make distributions to beneficiaries can separate their income into two segments for tax purposes: the income which the trust keeps for itself, and the income which the trust distributes. Since this is a deduction it is nonrefundable, meaning that a trust cannot deduct more in donations than it earned in taxable income. Charitable DonationsĪ trust may typically deduct any cash donations made to charity. The trust could then deduct half of its management and accounting fees. However, only $10,000 of that income was subject to taxes. For example, say that a trust received $20,000 worth of income in a given year.

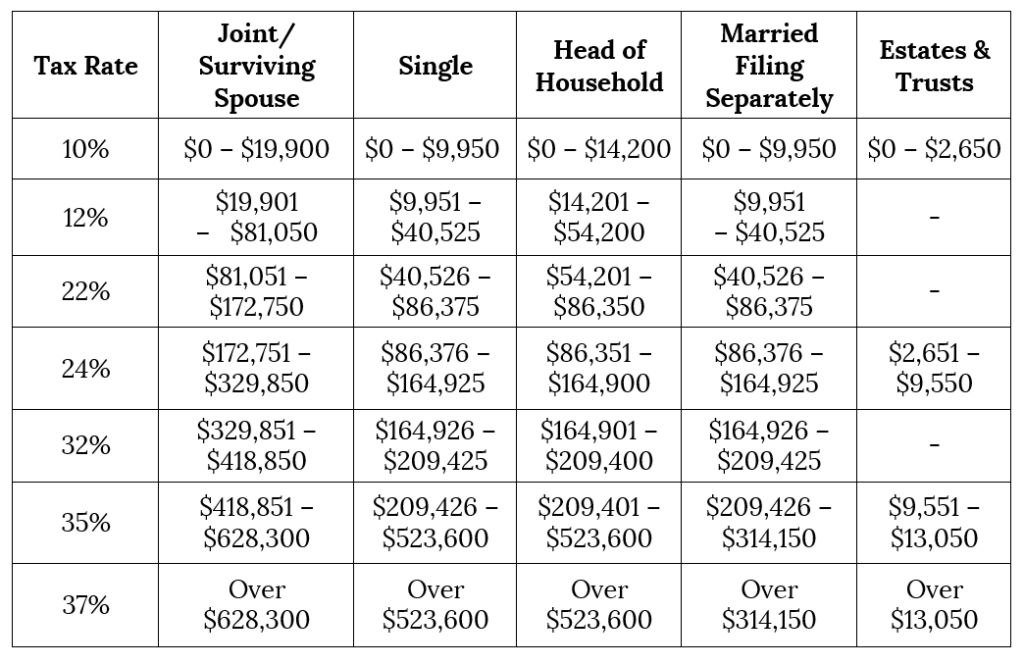

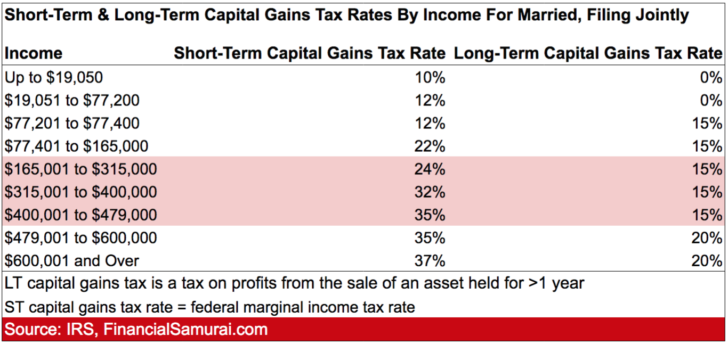

However, the trust may only deduct these fees based on the proportion of income that is taxable. The trust may deduct reasonable fees for trustee management and tax preparation. In 2023, that is set at $12.92 million for individuals and $25.84 million for couples. However, in some cases a beneficiary can still avoid paying any taxes if he or she has received less from the trust than lifetime gift tax exemption. When both could apply, distributions from a trust are considered to be first from the current year’s income (and so the beneficiary has to pay taxes on that money) and then from the principal. Any money that the trust earns and distributes in the same year, it does not pay taxes on. Any money in the trust’s principal has already been taxed. A beneficiary does not have to pay taxes on any distributions that the trust makes from its principal balance. Generally speaking, beneficiaries must pay taxes on any distributions they receive that the trust paid from income that it earned in the current tax year. The beneficiary of a trust may have to pay taxes on money that he or she receives. By and large the trust only pays taxes on income it generates from money and assets it holds. The person making this contribution has already paid taxes on the money, so the IRS considers this double taxation. The contributions made into a trust are generally not subject to income taxes. Here are four categories of primary deductions that concern trusts. Any income generated by rents or rental fees from these assets would be classified as ordinary income, not capital gains. Many manage assets such as buildings and property, for example. Most trusts generate a majority of their income through investments, but this is not a hard and fast rule. Once again, these tax brackets also apply to all income generated by estates. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. For trusts, there are three long-term capital gains brackets: Short-term capital gains (from assets held 12 months or less) and non-qualified dividends are taxed according to ordinary income tax rates. So, for example, if a trust earns $10,000 in income during 2023, it would pay the following taxes: The standard rules apply to these four tax brackets. Below is a breakdown of these rates and brackets: In 2023, the federal government taxes trust income at four levels. These tax levels also apply to all income generated by estates. However, this article will only address federal tax rates and exemptions, as the specific rates and regulations surrounding state trust taxation is beyond the scope of this article. Trusts pay federal, state and (when applicable) local taxes. Simple and complex trusts, however, have to directly pay taxes on all income, assets and tax events. With a grantor trust, the individual who established the trust pays all related taxes on the trust’s funds. They exert a potentially high degree of control over the trust’s assets depending on how the trust was established.

0 kommentar(er)

0 kommentar(er)